Teaching Kids About Money: Simple Lessons That Last a Lifetime

Teaching kids about money is one of the most important lessons we can pass down. When children learn how to manage money early, they grow up with the confidence to make smart financial decisions.

Most adults wish they had learned about finances sooner. By teaching kids financial literacy while they’re young, we give them tools to avoid debt, build wealth, and understand the value of hard work.

Start with the basics

Young children can grasp simple ideas like exchanging money for goods, the difference between needs and wants, and why saving is important. You don’t need a complex curriculum—just real-life examples and open conversations.

For example, let your child watch you create a grocery list and stick to a budget. Explain why you’re choosing certain items and skipping others. These simple money habits make a lasting impression.

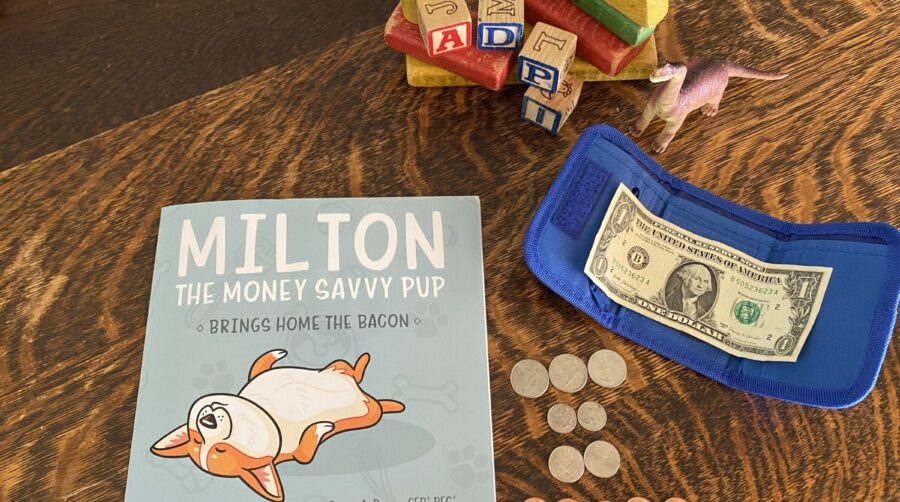

Another great way to teach is through play. Board games like Monopoly Junior or The Game of Life introduce financial concepts in a fun and memorable way. Even pretend play with a toy cash register can help toddlers understand how money works.

Introduce Budgeting

As kids grow older, introduce them to budgeting. Give them a small allowance and show them how to divide it into categories: save, spend, and give. This builds a foundation for responsible money management and encourages them to set goals.

Encourage Earning Money

In addition, talk to them about earning money. Encourage simple jobs like dog walking, lemonade stands, or chores for neighbors. Earning their own cash helps kids appreciate the effort behind every dollar.

Digital Money

Don’t forget to discuss digital money too. With online banking and mobile payments becoming the norm, children should understand how digital transactions work. Teach them about debit cards, online purchases, and the importance of protecting their financial information.

Mistakes are part of the learning process. Let them make small financial errors now, when the stakes are low. If your child spends all their allowance right away, resist the urge to bail them out. Instead, talk through what they’ll do differently next time. These lessons build resilience and decision-making skills.

Talk About Saving

Be open about your own money journey. You don’t need to share every detail, but talking about saving for a vacation, comparing prices, or making tough budget choices teaches kids that money isn’t just about spending—it’s about planning.

Final Thoughts

Financial education isn’t a one-time lesson. It’s a series of conversations, examples, and experiences that evolve as your child grows. Make it part of everyday life, and soon they’ll be asking smart questions and making wise choices.

When we start early, teaching children about money becomes second nature. With a few simple habits, real-life lessons, and your guidance, your kids can build a strong financial future—one choice at a time.

This page contains affiliate links. See affiliate disclaimer here. It is no additional cost to shop through these links, and Loyally Healing receives a small commission. Thank you for your support.

This page contains affiliate links. See affiliate disclaimer here. It is no additional cost to shop through these links, and Loyally Healing receives a small commission. Thank you for your support.